Fix & Flip | Buy-To-Rent Loans

Fix and Flip Loans

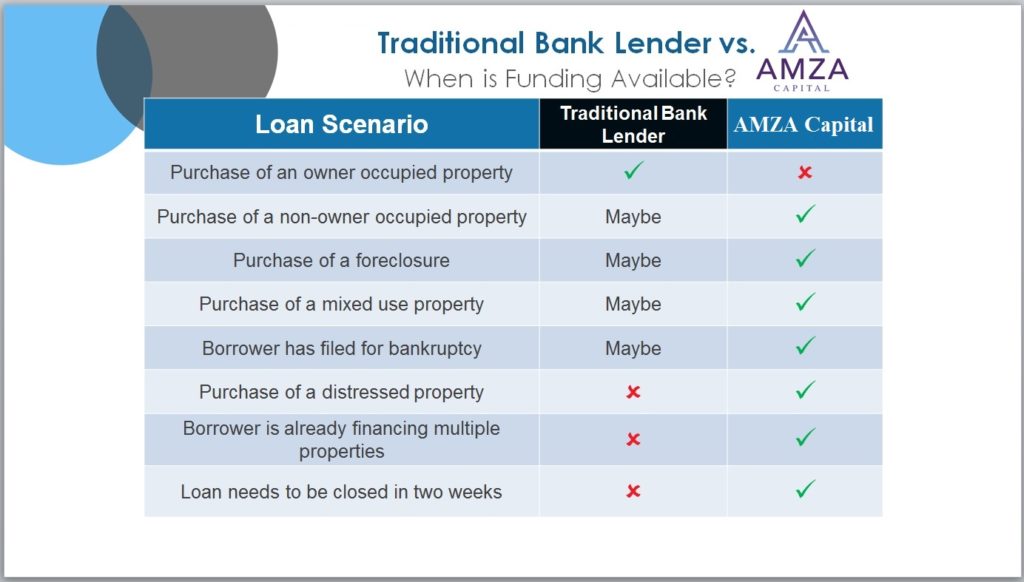

Are you a short-term real estate investor who knows how to hunt for fixer uppers at great prices, rehab those properties and then flip them for a profit? Do you have a minimum credit score of 650 or better? If so, a fix and flip loan can help you scale your profits in a very short amount of time. This kind of financing offers the savvy real estate investor great leverage to close fast on properties in almost any condition.

AMZA Capital is one of the nation’s leading lenders in the Fix and Flip space, offering hard-money loans to investors at highly competitive rates. Loans can go from application to funding in as little as two weeks.

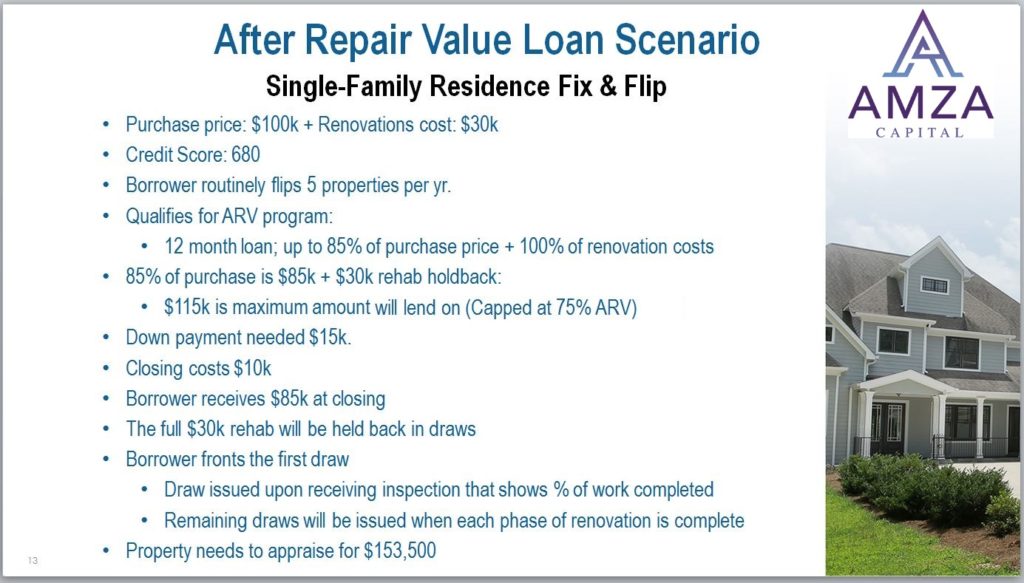

Typically a fix and flip investor will use a hard-money loan to purchase, rehab and sell a property within a one-year time frame, often in less than a few months.

Fix and Flip Hard Money Loans: Ideal Candidates

What kind of borrower is ideal for a fix and flip loan? Generally, borrowers fall into two broad camps – the experienced flipper with their own well-oiled teams or the novice flipper who uses a licensed contractor and/or investment real estate mentor to get their flipping career going.

Ideally, hard-money rehab loans fit the following real estate investors:

- Borrower credit score 650 or better

- Min purchase price (before rehab) $75,000 or higher

- Experienced flippers with a solid team and more than five flips under their belt

- First-time flippers working with a mentor and a licensed contractor

- Real estate investors competing against all-cash buyers

Rates and Terms

While hard money loans don’t come cheap, their short term nature and reasonable rates make them highly useful by the smart real estate investor. At the end of the day, the only thing that matters is profit margin. If the rates and terms allow an investor to make more profit per unit time vs not taking out the loan, then it obviously makes sense to leverage such funds.

Lender fees are typically taken right out of the loan and closing costs are either paid out of pocket or sometimes too are taken out of the loan.

For Single Family Homes, Fix & Flip, Hard money loan rates and terms are generally:

- Term: 12 months, 6 month extensions

- Time to Funding: 2-4 weeks

- Rates: 10% – 13%

- Lender Fees: 2% – 5%

- Closing Costs: $999

Fix and Flip Credit Line

The next step up from a fix and flip loan on an individual property, is a credit line to help the experienced investor flip multiple properties in a short time frame.

AMZA Capital offers credit lines from $3 million to $50 million for the seasoned investor who wants access to quick, reliable capital for multiple projects.

Features:

- Individual or multiple properties

- Single-family, condos, townhomes, multi-family < 20 units

- Nationwide lending

- $3M – $50M

- Loans up to 80% of cost

- Fixed rates

- Up to 24-month terms

- Purchase or refinance

- Revolving options available

- Foreign nationals acceptable

Buy-To-Rent Loans

Whether buying a single-family residence or a 5+ unit apartment to rent out, AMZA Capital can help the mid-sized rental real estate investor with loans up to $2.5 million. Larger investors who qualify can borrow into the tens of millions of dollars or even more under our commercial real estate financing options.

A typical Buy-to-Rent loan for a mid-sized real estate investor generally follows these criteria:

- FICO 680 or greater

- Purchase LTVs up to 80%

- Cash Out Refinance LTVs up to 75%

- Terms up to 30-years, fixed rate

- Single-family, condos, townhomes, multi-family

- Min Property Value of $135,000

- Min Loan $100k

- Nationwide lend